Discover essential the Physical Therapy Medicare billing guidelines, including accurate use of ICD-10 and CPT codes, understanding service-based and time-based codes, and following the 8-minute rule to ensure compliance and maximize reimbursement.

As physical therapists, one of the most fulfilling aspects of our job is helping patients regain their quality of life after an injury or health issue. However, not everything we do is as enjoyable. Medicare billing, while a crucial part of our practice, can be complex and tedious. Proper billing ensures that clinics are reimbursed and therapists are paid for their services. Today, we’ll dive into what might be the most challenging part of our profession: Medicare billing. With different standards for acceptable CPT codes, unit limitations, and reimbursement structures, it’s essential to understand Medicare’s unique guidelines. Let’s get started.

ICD-10 Codes: The Starting Point

-

The billing process begins after the initial evaluation with the selection of ICD-10 codes to open a claim.

- Typically, ICD-10 codes are provided by the referring physician.

- In states allowing direct access to PT services, therapists may need to assign the codes based on the evaluation.

- Always choose the most specific code(s) that accurately describe the patient’s condition or reason for therapy.

CPT Codes: The Core of Medicare Billing

CPT codes are the backbone of billing and must reflect the services rendered during each session. These codes are subject to strict Medicare scrutiny, making accuracy essential.

- Most PT-related codes fall under the 97000 section, which includes:

- Initial evaluations (categorized as low, moderate, or high complexity)

- Therapeutic procedures (e.g., therapeutic exercises, manual therapy)

- Neuromuscular re-education

- Group therapy and supervised modalities

For evaluation codes, complexity is determined by factors such as patient history and clinical presentation. Proper classification ensures compliance and appropriate reimbursement.

Service-Based vs. Time-Based CPT Codes

Understanding the difference between service-based and time-based codes is crucial:

- Service-Based Codes:

- Examples: Initial evaluation, re-evaluation, unattended electrical stimulation, hot/cold packs.

- Billed as one unit, regardless of time spent.

- Time-Based Codes:

- Examples: Therapeutic exercises, manual therapy, gait training, attended modalities.

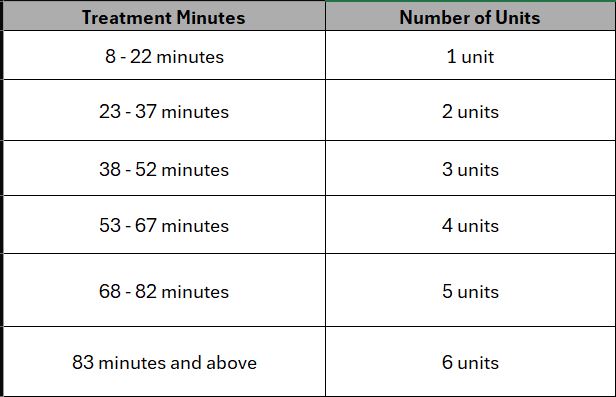

- Require adherence to the 8-minute rule.

For example, if you spend 18 minutes on therapeutic exercise and 10 minutes on manual therapy, your total treatment time is 28 minutes. You would bill 2 units.

Key Considerations for Medicare Billing

- Service-Based Codes Are Not Subject to the 8-Minute Rule:

These codes can still be billed in addition to time-based codes, provided the service is medically necessary. - Document Total Treatment Time:

Combine timed and untimed minutes to ensure accurate unit allocation. - Stay Updated on Medicare Policies:

Guidelines frequently change, making ongoing education essential for compliance and maximizing reimbursements.

Why Accuracy Matters

Navigating Medicare billing is undoubtedly complex, but with a solid understanding of ICD-10 and CPT codes, service classifications, and the 8-minute rule, the process becomes more manageable. Proper billing ensures compliance, reduces the risk of denied claims, and helps secure fair compensation for the valuable services you provide.

By staying informed and organized, you can focus on what you do best—helping your patients regain their health and quality of life.

Here is the updated Physical Therapy Medicare Billing Guidelines 2025.