97110 vs 97530: How to Choose the Right CPT Code for Therapy Billing

Table of Contents

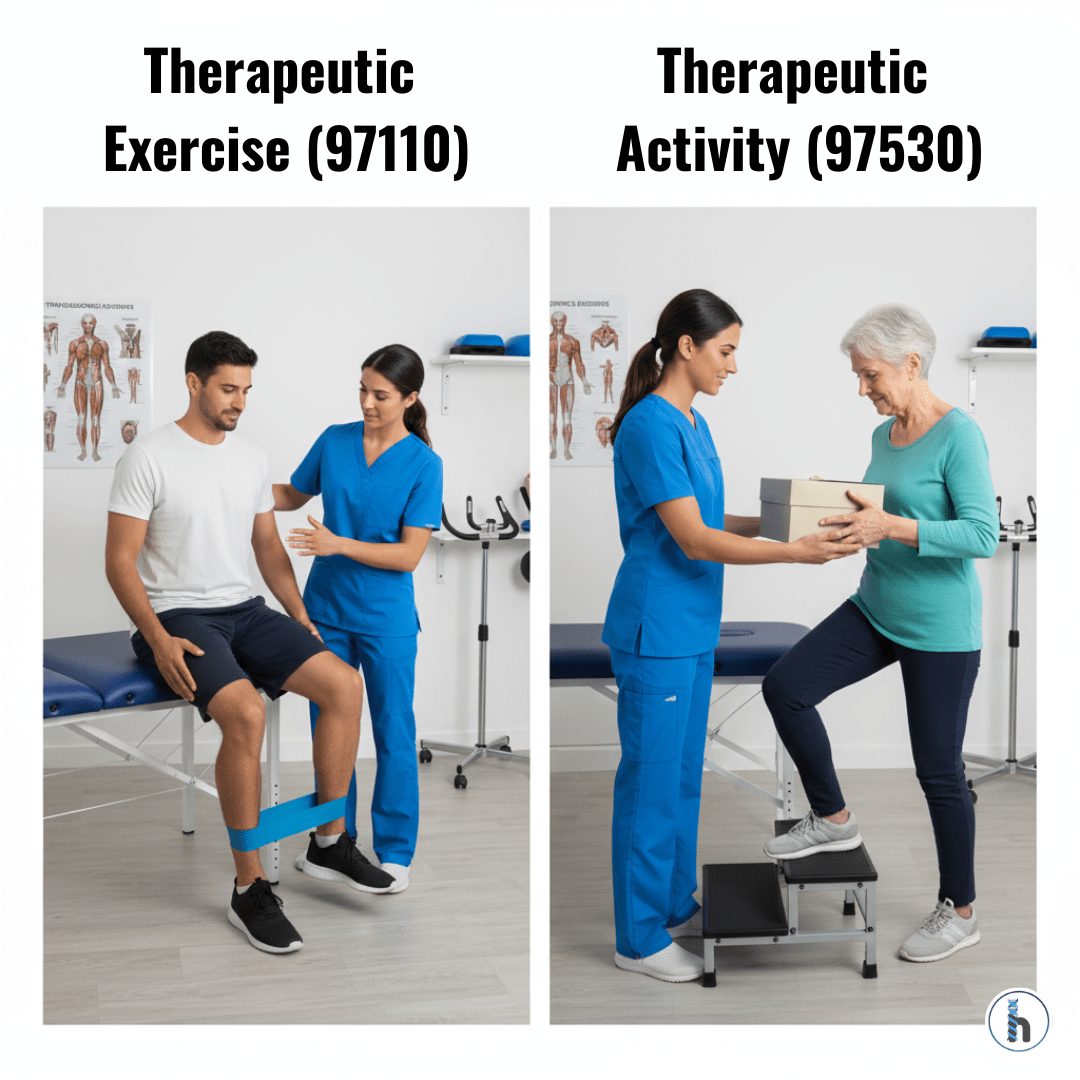

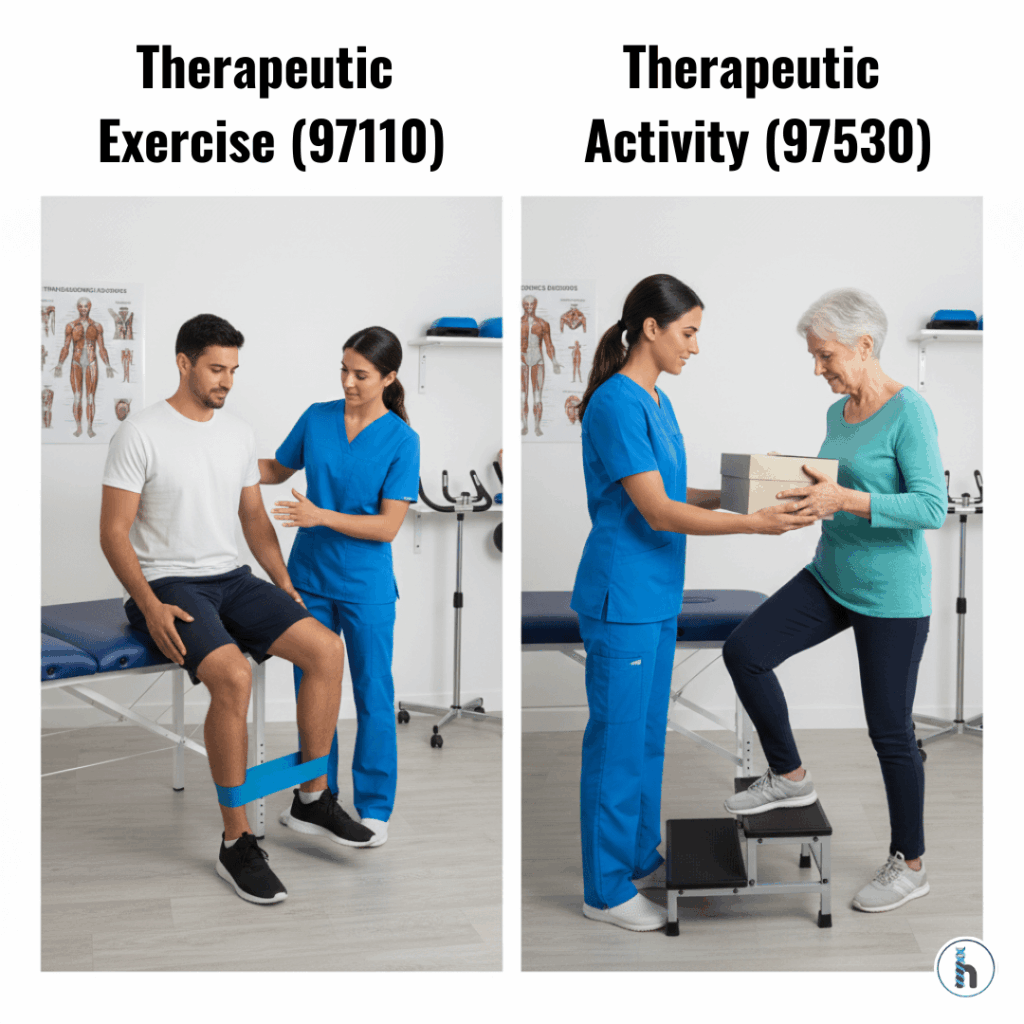

Understanding 97110 vs 97530 is essential for accurate documentation, clean billing, and preventing costly denials. These two CPT codes Therapeutic Exercise (97110) and Therapeutic Activity (97530) are frequently misunderstood because they share similar goals yet represent very different types of interventions.

This guide explains when to use each code, key documentation requirements, billing rules, examples, and how an EMR like HelloNote helps streamline compliant coding.

What’s the Difference Between 97110 and 97530?

Therapeutic exercise and therapeutic activity are both time-based CPT codes used by PT, OT, and SLP professionals. However, they address different clinical purposes.

Why Choosing the Right CPT Code Matters

Selecting the incorrect code can result in:

Reduced reimbursement

Compliance risks

Increased audit exposure

Understanding 97110 vs 97530 ensures you bill accurately and reflect true clinical intent.

CPT Code 97110 Therapeutic Exercise

What Is 97110?

Structured exercises used to improve strength, flexibility, ROM, or endurance.

Required Documentation for 97110

Documentation must include:

Body region treated

Specific muscles or joints

Purpose of each exercise

Relation to functional goals

Examples of 97110 Exercises

ROM exercises

Resistance training

Aerobic conditioning

Stretching

CPT Code 97530 Therapeutic Activities

What Is 97530?

Functional, dynamic, real-world activities that simulate daily tasks.

Required Documentation for 97530

Documentation should show:

Real-life task simulation

Functional significance

Multiple movement components

Direct link to functional goals

Examples of 97530 Activities

Lifting and carrying objects

Stair training

Reaching while balancing

Simulated transfers

Billing Guidelines for 97110 vs 97530

Both codes follow:

15-minute increments

Using Modifier 59

Required when billing both codes in the same session.

Insurance Considerations

Medicaid: Often covers 97530, not always 97110

Private payers: Usually reimburse both with clear documentation

Medicare: Rates vary; 97530 often reimburses slightly higher

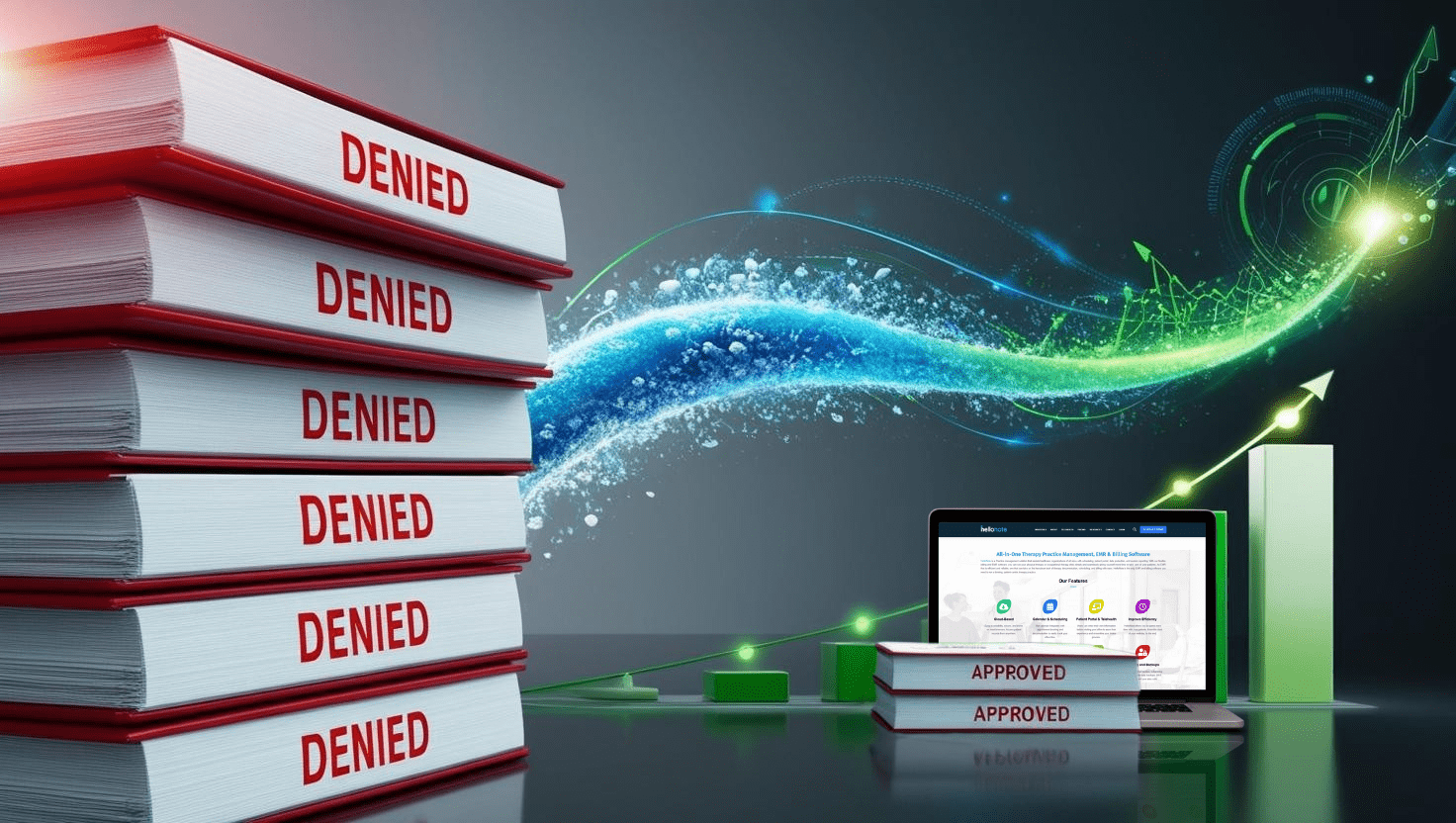

Common Reasons for Claim Denials

Insufficient Documentation

Vague vs. detailed examples included.

Incorrect Dual Billing

Must justify why both codes were used.

Time Rule Errors

Failure to meet the 8-minute rule leads to denials.

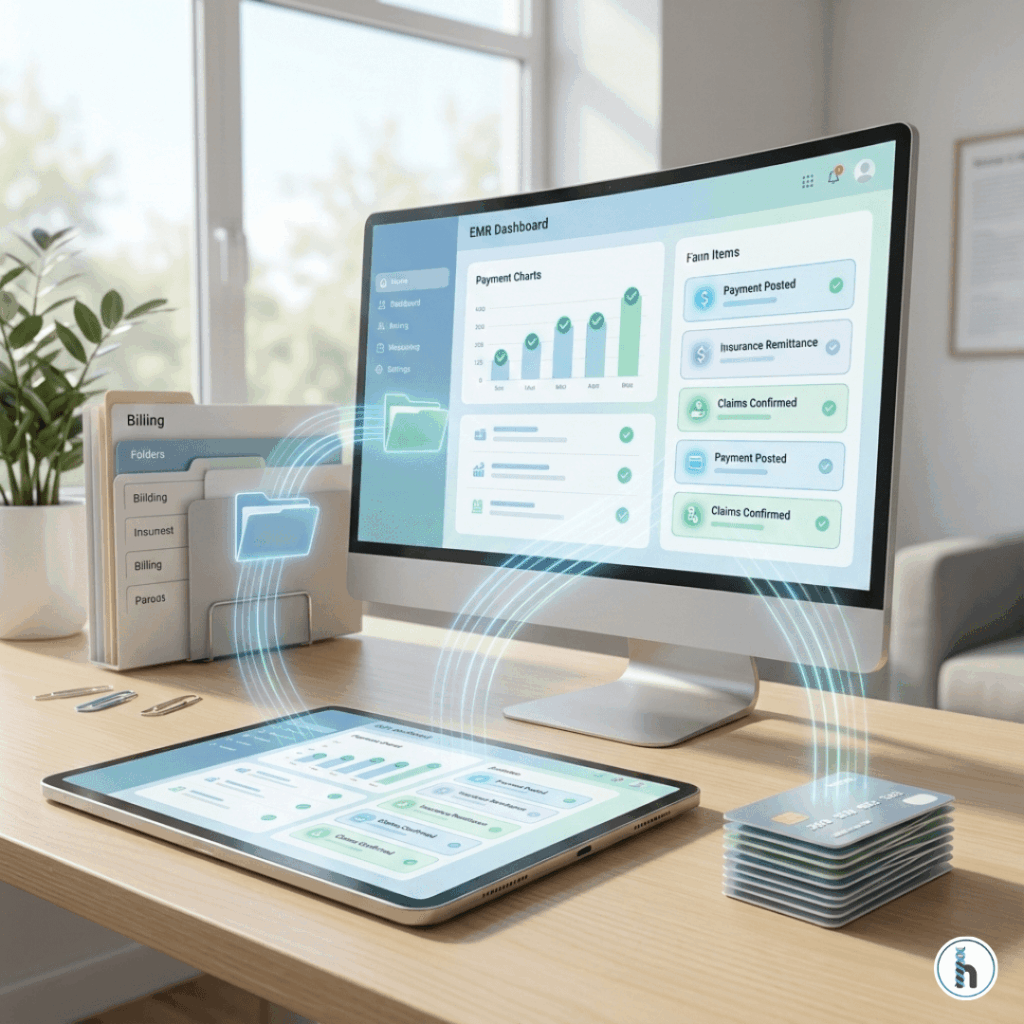

How HelloNote EMR Simplifies 97110 vs 97530 Coding

HelloNote helps clinics by:

Auto-applying modifiers

Providing documentation guidance

Validating codes before claim submission

Tracking progress and medical necessity

Final Thoughts on 97110 vs 97530

Mastering these distinctions helps ensure:

Accurate documentation

Fewer denials

Higher reimbursement

Better compliance

Frequently Asked Questions (FAQ)

97110 focuses on improving measurable physical components like strength, endurance, or range of motion. In contrast, 97530 targets functional, real-world activities such as lifting, reaching, transfers, or stair climbing. If the activity simulates daily tasks and involves multiple movement parameters, it should be billed under 97530.

Yes — but only if each service is distinct and separately documented. Modifier 59 must be applied to indicate that the therapist provided two unique interventions with different goals. Without clear documentation, payers may deny one of the codes as duplicate billing.

CPT 97530 (Therapeutic Activity) generally reimburses at a higher rate because it involves more complex, functional, and task-oriented interventions. However, exact reimbursement varies by payer, state, and contract.

Coverage varies by state. Many Medicaid programs reimburse 97530 but have stricter limitations or exclusions for 97110. Clinics must verify Medicaid coverage for each patient before billing to prevent denials.

HelloNote automates modifier logic, validates CPT code selection, and prompts therapists when documentation is incomplete. It streamlines billing, reduces denials, and ensures compliance with 97110 vs 97530 rules, helping clinics protect revenue and improve claim approval rates.