Pediatric Occupational Therapy CPT Codes: What to Use, How to Document, and How to Get Paid

Table of Contents

Billing for pediatric occupational therapy is rarely straightforward. Sessions often involve play-based interventions, caregiver education, sensory regulation, and developmental activities that don’t always fit neatly into a single box. Yet accurate coding remains critical not just for reimbursement, but for compliance, audit readiness, and long-term practice sustainability.

Understanding pediatric occupational therapy CPT codes helps ensure that the care you provide is clearly reflected in your documentation and supported during billing review. This guide breaks down the most used codes, how they apply in pediatric settings, and how proper documentation supported by the right EMR can reduce denials and administrative stress.

Why CPT Coding Matters in Pediatric OT

In pediatric occupational therapy, documentation must tell a clear clinical story. Payers want to understand:

- What service was provided

- Why it was medically necessary

- How the intervention addressed functional goals

- How time was spent during the session

Using the correct CPT code helps translate your clinical work into language insurers recognize. When coding and documentation are misaligned, even well-delivered care can result in delayed or denied claims.

Common Pediatric Occupational Therapy CPT Codes

While every child and plan of care is different, several CPT codes appear frequently in pediatric OT settings.

97165–97167: Occupational Therapy Evaluation

These codes are used for initial evaluations and are selected based on complexity:

- 97165 – Low complexity

- 97166 – Moderate complexity

- 97167 – High complexity

Selection depends on factors such as performance deficits, assessment tools used, clinical decision-making, and comorbidities. Accurate evaluation documentation is essential, as this code often sets the foundation for authorization and future billing.

97110: Therapeutic Exercise

Used when interventions focus on strength, coordination, or motor control with measurable physical outcomes. In pediatrics, this may apply when exercises are structured and goal-directed rather than purely play-based.

97530: Therapeutic Activities

This is one of the most commonly used pediatric OT codes. It applies to dynamic activities that improve functional performance, such as:

- Fine motor tasks

- Play-based skill building

- Task sequencing and problem-solving

Clear documentation should connect the activity directly to functional goals.

97112: Neuromuscular Reeducation

Appropriate when sessions target balance, coordination, postural control, or sensory-motor integration. This code is often used in children with neurological or developmental conditions.

97535: Self-Care / Home Management Training

Used when addressing activities of daily living such as dressing, feeding, grooming, or caregiver education related to these tasks.

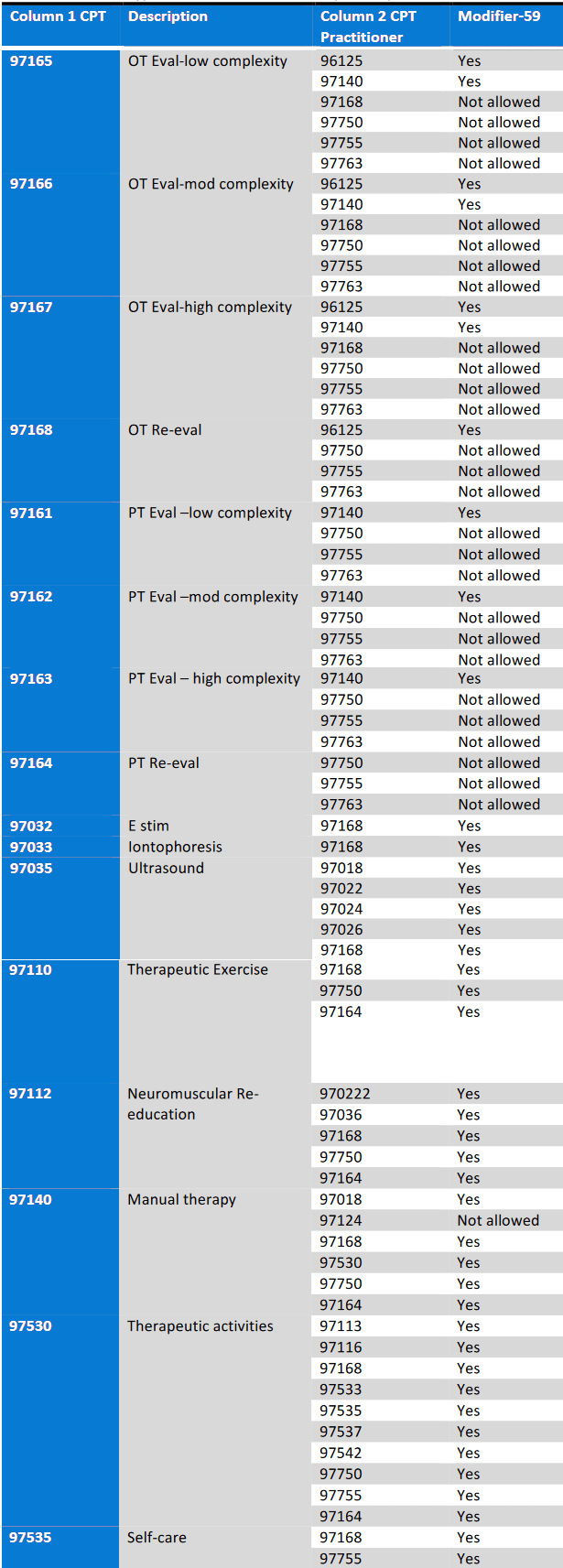

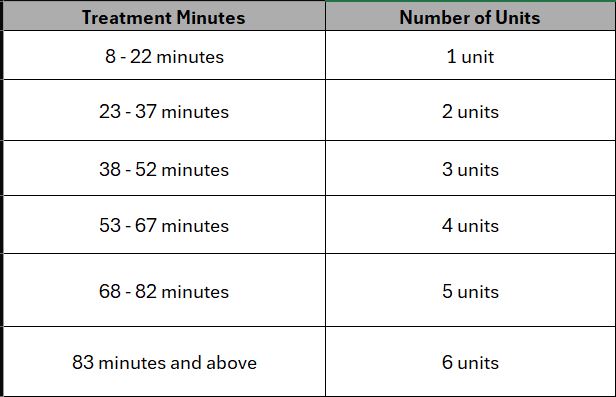

Time-Based Coding Considerations

Many pediatric occupational therapy CPT codes are time-based and billed in 15-minute units. Accurate time tracking is critical.

Your documentation should clearly show:

- Total treatment time

- How time was divided across interventions

- Which activities were billed under each code

Incomplete or inconsistent time documentation is a common trigger for payer denials.

Documentation Tips That Support Clean Billing

To support compliant use of pediatric occupational therapy CPT codes, your notes should consistently include:

- Functional goals tied to the plan of care

- A brief description of skilled intervention

- The child’s response to treatment

- Progress toward measurable outcomes

- Time spent per intervention

This level of clarity helps payers understand not just what you did, but why it required skilled occupational therapy services.

Common Coding Mistakes to Avoid

Even experienced therapists can run into issues when:

- Using generic language that doesn’t match the billed code

- Repeating the same CPT code without documenting skilled progression

- Failing to link session activities to functional goals

- Mixing evaluation and treatment services without clarity

Avoiding these pitfalls starts with structured documentation and clear visibility into goals and services provided.

How the Right EMR Supports Pediatric OT Coding

An EMR built for therapy practices can significantly reduce coding errors. With pediatric-focused workflows, therapists can:

- Select CPT codes directly within daily notes

- Track time automatically per intervention

- Link goals to billed services

- Maintain consistency across evaluations, progress notes, and treatment sessions

When documentation and billing workflows live in the same system, it becomes easier to defend claims and respond to payer requests.

Supporting Long-Term Practice Health

Accurate use of pediatric occupational therapy CPT codes isn’t just about reimbursement—it’s about protecting your practice. Clean billing leads to:

- Fewer claim denials

- Faster payments

- Lower audit risk

- Less administrative rework

Over time, these efficiencies translate into better cash flow, reduced staff burnout, and more time spent with patients instead of paperwork.

Frequently Asked Questions

Evaluation codes (97165–97167), therapeutic activities (97530), neuromuscular reeducation (97112), and self-care training (97535) are among the most frequently used.

The correct code is based on complexity, including the number of performance deficits, assessment tools, and clinical decision-making required.

Yes, as long as each service is distinct, time is documented accurately, and interventions are tied to functional goals.

Common reasons include insufficient documentation, time discrepancies, vague descriptions, or mismatch between the CPT code and the intervention provided.

A therapy-specific EMR helps align documentation with billing, track time automatically, and ensure consistency across notes reducing errors and denials.

Final Takeaway

Pediatric occupational therapy is complex, skilled work. Your documentation and coding should reflect that complexity clearly and confidently. By understanding how CPT codes apply in pediatric settings and using systems that support accurate workflows you can focus more on patient care and less on billing headaches.