Deciding on Accepting Insurance vs. Being Cash-Based. Which is Right for your Clinic?

A cash-based physical therapy clinic offers personalized care by removing insurance restrictions. This model prioritizes one-on-one sessions, eliminates visit limits, and reduces administrative challenges. By focusing on patient needs instead of insurance policies, clinics can provide high-quality treatment and streamline billing with superbills, ensuring a smoother experience for both therapists and patients

As a clinic owner you have to make the decision as to whether or not you will accept healthcare insurance or if you want your services to be cash-based, meaning the patient pays on their own, a set rate for each session. There are pros and cons to accepting both types of payments so your decision ultimately depends on what your goal is for your clinic. There is also no rule that says if you start out accepting healthcare insurance that you cannot switch over to cash-based services at a later date.

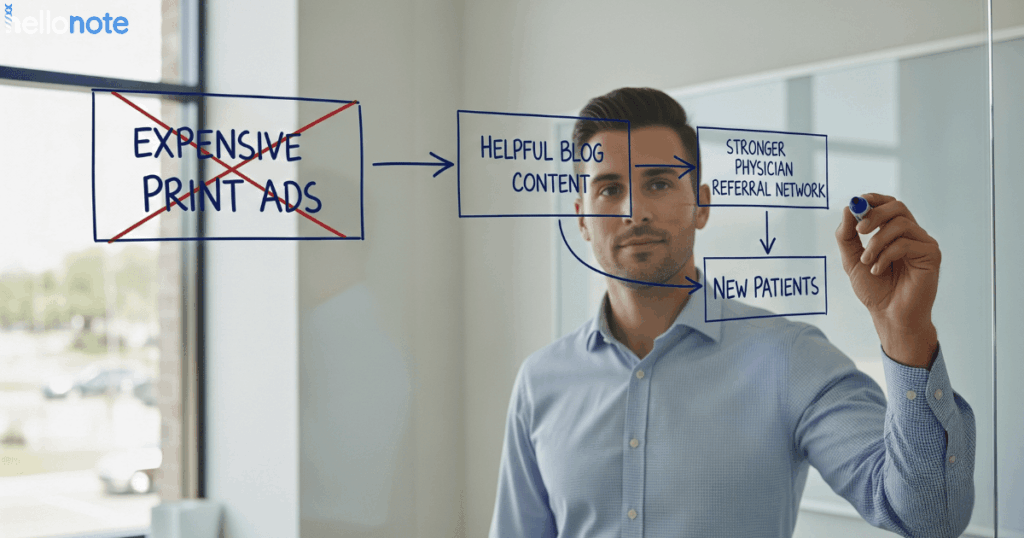

Cash-based physical therapy clinics have increased in frequency over the past several years with the main reason being that companies are tired of having to follow the rules of insurance for continued therapy approvals and reimbursements. So the question becomes, if you accept healthcare insurance as the main form of payment for your clinic, at what point is the insurance reimbursement just not worth it?

Over the years, healthcare providers, specifically physical and occupational therapists, have seen significant cuts in reimbursement from insurance companies, such as third-party payers and Medicare. For instance, consider the Medicare reimbursement cut that is happening for therapists in 2022. With these reimbursement cuts comes the added issue and concern of how healthcare providers and clinics can provide care while remaining profitable. In most cases, physical therapy practices will take the following measures to ensure their clinic doors can remain open:

- Seeing multiple patients per hour, sometimes double or triple booking patients each hour, resulting in decreased 1:1 patient care

- Using inexpensive modalities that may not be as effective as others

- Eliminating physical/occupational therapy assistants and assigning more responsibilities to technicians/aides who lack specific therapy education

When you look at these measures, the number one thing they have in common is that they all lead to overall decreased quality of care because the patient is no longer coming first. Instead, patient care is being driven by insurance reimbursements to be able to maintain a profit margin. When the patient no longer comes first because the reimbursement rate is so low, perhaps it is time for your clinic to consider switching to out-of-network or cash-based services.

By switching to providing cash-based or out of network services, your clinic no longer has to follow the rules of insurance. This means you can focus on putting the patient first and providing them with the care they deserve, without having to worry about additional approval for more visits or if your reimbursement claim will be denied.

Below are some of the benefits of running or transitioning to a cash-based clinic:

- Exclusive 1-on-1 Treatment: Yes, you read that correctly. When insurance is not the primary source of income for a clinic, the physical therapist is able to spend one-on-one time, for an entire hour, with each patient. One-on-one time allows the patient to receive the therapist’s full attention each session to be able to provide the highest quality of care which typically results in decreased recovery times!

- No visit limits: Oftentimes after surgery, many patients will require 8-12 weeks of recovery to be able to achieve their goals and return to their prior level of function. However, insurances typically limit the number of visits a patient is able to be seen meaning therapists then have to go through a rigorous authorization process for more visits, which typically results in no additional visits being improved. When you take insurance out of the equation, the patient is able to be seen for as many sessions as needed without having to worry about a cap or limit allowing each patient to be treated as a whole, instead of being viewed as just an injury.

- Typically less expensive than normal physical therapy: A lot of times the first quarter of the year is slow for physical therapy clinics because many patients have not reached their deductible for the year. If a patient has not met their deductible and they go to an insurance-based clinic, the cost of their copay on top of paying out of pocket (because they haven’t met their deductible), can cost the same if not more than a cash-based session. By going to a cash-based clinic, the time of year the patient receives treatment is no longer based on whether or not they have met their deductible, instead it’s based on when the patient needs the treatment!

- The patient can submit therapy bills to insurance: Oftentimes cash-based clinics will provide patients with superbills that can be submitted to their insurance companies, meaning patients submit for the reimbursement, not the clinic. This allows the physical and occupational therapists to focus their attention on the patient, instead of using up the majority of their energy trying to ensure they are typing in the correct treatment and billing codes for each session.

If you are a clinic owner, it is ultimately your decision as to whether or not you accept insurance payers or choose a cash-based model for your services. When determining whether or not your clinic should accept insurance as the primary payer, consider the above and the goals you have for your specific clinic. Regardless of which route you choose, HelloNote can assist you with all of your documentation needs, and if accepting insurances, billing needs, while eliminating all of the usual billing stress and hassle!

Trends in Cash-Based vs. Insurance-Based Therapy Practices 2025 the latest update.